Debt Consolidation Loans for Bad Credit offer a solution for multiple high-interest debts, reducing monthly expenses and improving cash flow. Assessing credit scores and eligibility is crucial before applying. Exploring low-interest rates from various lenders saves money and simplifies repayment. Understanding loan terms, including repayment periods and fees, is essential to finding the best deal. Securing multiple offers and comparing them strategically helps individuals with bad credit find tailored solutions, enhancing their financial control and future loan opportunities.

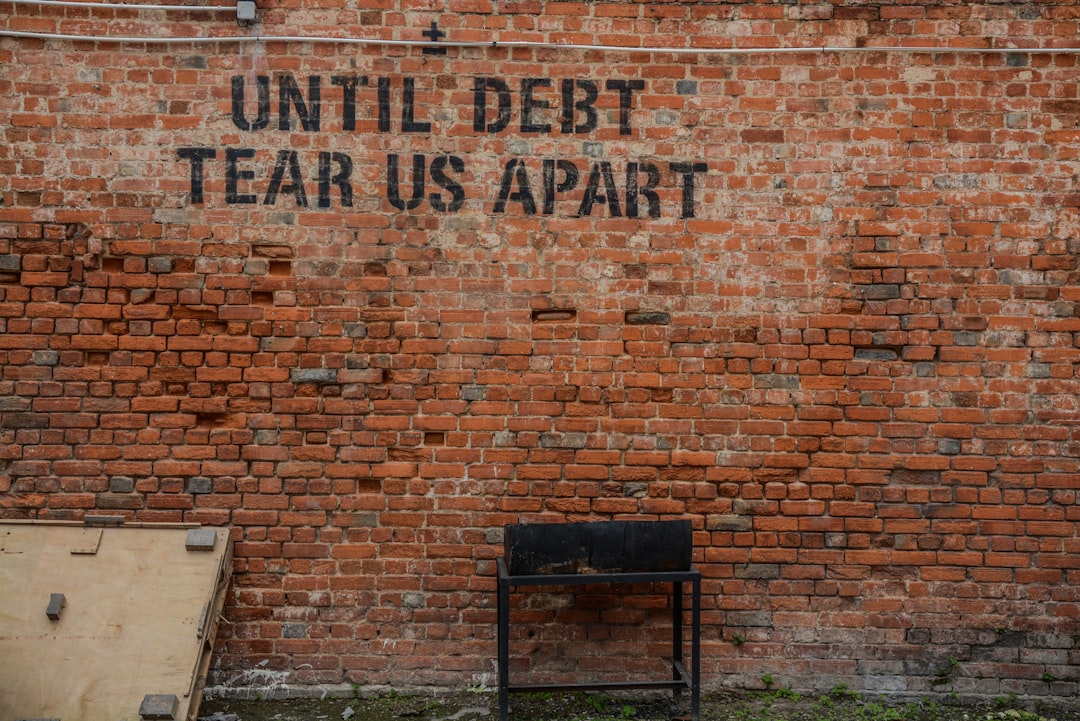

Debt consolidation loans can offer a fresh start by simplifying multiple high-interest payments into one manageable, lower-rate loan. But with various lenders offering different terms and rates, finding the best deal for your financial situation is crucial. This guide explores debt consolidation loans, focusing on low-interest options available to individuals with bad credit. We’ll break down eligibility, compare lender offerings, and provide strategies to secure the most favorable terms for consolidating your debts effectively.

- Understanding Debt Consolidation Loans and Their Benefits

- Assessing Your Credit Score and Eligibility

- Exploring Low-Interest Rate Options from Various Lenders

- Comparing Loan Terms: Repayment Periods and Fees

- Strategies for Securing the Best Debt Consolidation Deal

Understanding Debt Consolidation Loans and Their Benefits

Debt consolidation loans are a popular choice for individuals looking to simplify their financial obligations, especially those with multiple high-interest debts. These loans allow borrowers to combine various debt into one single loan with a lower interest rate, making it easier to manage payments and potentially save money in the long run. For those with bad credit, accessing Debt Consolidation Loans for Bad Credit can be a viable option to regain financial control.

By consolidating debts, borrowers can reduce their monthly expenses, as they’ll only need to make one payment instead of several. This simplification can improve cash flow and potentially help individuals avoid defaulting on their debts. Additionally, with a debt consolidation loan, there might be no prepayment penalties, giving borrowers the flexibility to pay off the loan faster if their financial situation improves.

Assessing Your Credit Score and Eligibility

When considering debt consolidation loans, one of the initial and crucial steps is assessing your credit score and eligibility. Lenders will evaluate your financial health based on various factors, with your credit score being a primary indicator. For individuals dealing with debt consolidation loans for bad credit, this process can be challenging but not impossible. A lower credit score typically signifies higher risk to lenders, which may result in less favorable loan terms. However, understanding your score and what influences it empowers you to take proactive measures before applying.

Checking your credit report regularly allows you to identify errors or discrepancies that could negatively impact your score. Additionally, improving your credit mix by diversifying debt can positively affect your overall rating. While securing a loan with collateral might be an option for bad credit borrowers, it’s essential to weigh the risks carefully. Ultimately, being informed about your financial standing is key to finding suitable debt consolidation loans for bad credit and managing them effectively.

Exploring Low-Interest Rate Options from Various Lenders

When considering debt consolidation loans for bad credit, exploring low-interest rate options from various lenders is a strategic move to save money and streamline repayment. Unlike traditional loans, debt consolidation loans bundle multiple debts into one with potentially lower interest rates, making it easier to manage your finances. The key lies in comparing offers from different lenders, keeping an eye out for hidden fees, and understanding the loan terms thoroughly.

Diversifying your search among multiple lenders gives you a broader perspective on what’s available in the market. Each lender may have unique criteria for offering low-interest rates, which could be based on credit history, income levels, or the type of debt being consolidated. By exploring these options, individuals with bad credit can find tailored solutions that align with their financial needs and help them regain control over their debt.

Comparing Loan Terms: Repayment Periods and Fees

When comparing debt consolidation loans for bad credit, a key factor is examining the loan terms, particularly repayment periods and associated fees. Each lender will offer different conditions, so it’s essential to understand what you’re signing up for. Repayment periods can vary widely, typically ranging from 3 to 10 years, with shorter terms often resulting in higher monthly payments but saving on interest over time.

Fees are another critical aspect; these can include application fees, origination charges, and early repayment penalties. Some lenders may offer competitive rates and flexible terms, but charge hefty fees upfront, while others might have lower or no hidden fees. Carefully reviewing the small print and comparing these costs across multiple lenders will help you secure the best deal for your financial situation.

Strategies for Securing the Best Debt Consolidation Deal

Securing the best debt consolidation deal requires a strategic approach, especially for individuals dealing with bad credit. One key strategy is to compare offers from multiple lenders. Each lender has its own set of terms and conditions, interest rates, and repayment plans, so shopping around allows you to find the most favorable options tailored to your financial situation. It’s crucial to look beyond just the interest rate; consider fees, repayment periods, and any additional benefits or perks offered.

Additionally, maintaining a good credit standing or actively working on improving it can make a significant difference. Lenders often offer better rates to borrowers with higher credit scores. While debt consolidation loans for bad credit are available, they might come with higher interest rates. Therefore, focusing on credit score enhancement could open doors to more accessible and cost-effective loan options in the future.

When considering debt consolidation loans, especially for those with less-than-perfect credit (debt consolidation loans for bad credit), a thorough comparison of offers from multiple lenders is key. By understanding the benefits, assessing your financial health, and strategically evaluating loan terms, you can secure a deal that simplifies your debt repayment journey without adding unnecessary strain to your budget. Remember, the right loan can transform your financial landscape, so take the time to explore and compare before making a decision.