Debt consolidation loans for bad credit provide a strategic solution for managing multiple high-interest debts. By combining eligible debts like personal loans and credit cards into one loan, individuals can secure reduced monthly payments and lower interest rates over time. It's crucial to understand the terms and explore loan types, such as secured or unsecured options, where secured loans may require collateral while unsecured loans offer flexibility. This approach empowers people with bad credit to find suitable solutions and improve their financial standing.

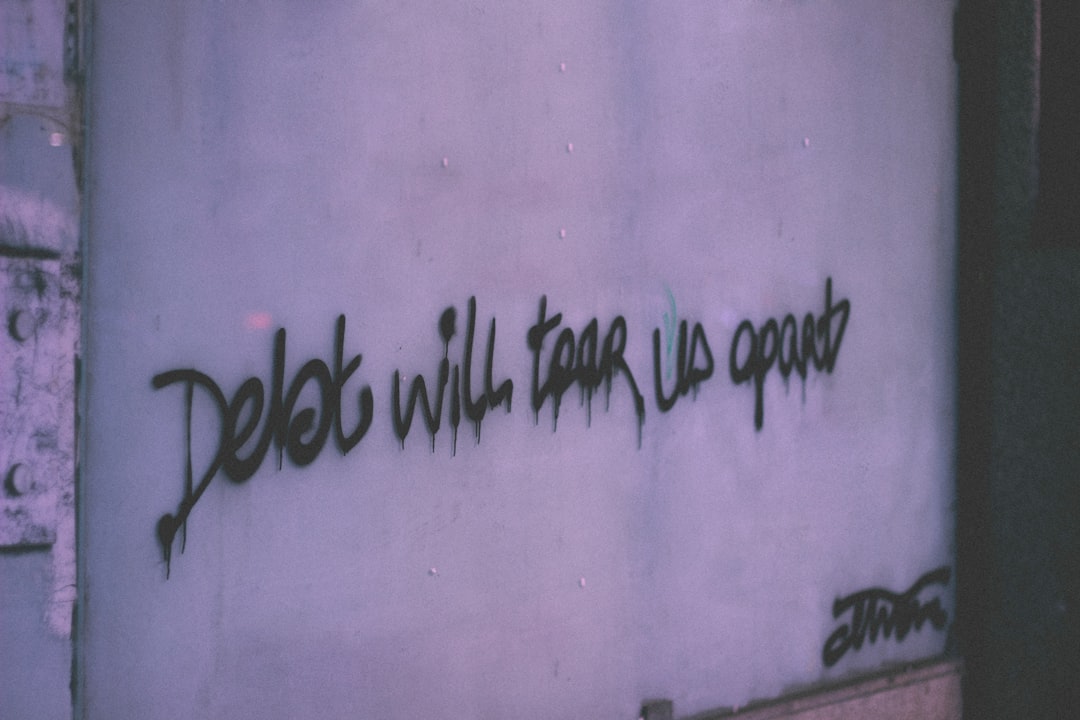

Struggling with multiple personal loan and credit card debts? Debt consolidation could be a viable solution. This article guides you through understanding debt consolidation loans for bad credit, offering a comprehensive overview of various consolidation options available today. By exploring different types tailored to specific financial needs, you can make an informed decision to simplify payments and potentially reduce overall debt.

- Understanding Debt Consolidation Loans for Bad Credit

- Exploring Different Types of Debt Consolidation Options

Understanding Debt Consolidation Loans for Bad Credit

Debt consolidation loans for bad credit are a popular option for individuals looking to streamline multiple high-interest debts into a single, more manageable loan. These specialized loans are designed to help those with lower credit scores secure funding to pay off their existing debts. The process involves consolidating all your eligible debts, including personal loans and credit cards, into one loan with a potentially lower interest rate. This can significantly reduce monthly payments and the overall cost of borrowing over time.

When considering debt consolidation for bad credit, it’s crucial to understand the terms and conditions thoroughly. Lenders will typically assess your creditworthiness based on factors like income, existing debts, and credit history. They may offer various loan types, such as secured or unsecured loans, each with its own set of requirements and benefits. Secured loans often require collateral, while unsecured options provide flexibility without needing a down payment. Exploring these options can help individuals with bad credit find the most suitable debt consolidation solution to improve their financial situation.

Exploring Different Types of Debt Consolidation Options

When exploring debt consolidation options, it’s crucial to understand the variety of choices available, especially for those with bad credit. Debt consolidation loans specifically tailored for poor credit scores offer a viable path toward financial relief. These loans aren’t just about merging debts; they provide an opportunity to restructure repayment terms, making them more manageable and affordable.

Options like secured debt consolidation loans, where borrowers use an asset as collateral, can lead to lower interest rates. Alternatively, unsecured loans might be suitable for those without significant assets, but they typically carry higher interest rates. Each option has its pros and cons, so understanding one’s financial situation, credit history, and goals is essential before deciding on the best debt consolidation route.

Debt consolidation can be a powerful tool for managing personal loan debts and credit cards, especially for those with bad credit. By exploring options like secured loans, unsecured loans, or even balance transfer cards, individuals can streamline their repayments and regain financial control. Understanding the various types of debt consolidation loans for bad credit available allows borrowers to make informed decisions tailored to their unique circumstances, ultimately leading to better financial health.