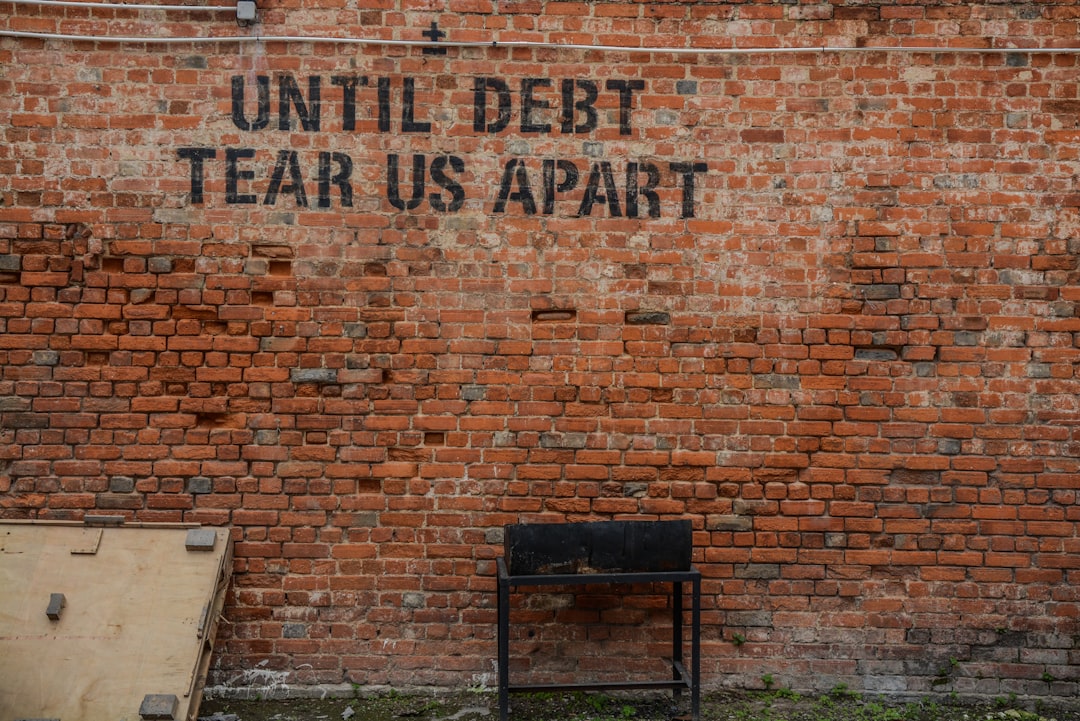

Debt Consolidation Loans for Bad Credit in the UK offer a flexible solution for individuals with poor credit histories. These loans combine multiple debts into one lower-interest loan with simplified repayment through a single fixed monthly instalment. Unsecured options avoid asset seizure risks, making them an attractive choice for rehabilitating financial standing despite less-than-perfect credit.

Struggling with debt and a poor credit history? Discover the options available for Debt Consolidation Loans For Bad Credit in the UK. This guide explores how to navigate debt consolidation despite challenges like bad credit or no credit check requirements. We’ll delve into the nuances of these loans, offering practical strategies to help you make informed decisions and take control of your financial future. From understanding different loan types to tips for improving your chances of approval, this article is your comprehensive resource.

- Understanding Bad Credit Debt Consolidation Loans UK

- How No Credit Check Loans Work for Debtors

- Top Strategies for Securing Debt Consolidation with Bad Credit

Understanding Bad Credit Debt Consolidation Loans UK

Debt Consolidation Loans For Bad Credit in the UK are designed to help individuals with poor credit histories or no credit checks manage and reduce their debt obligations more effectively. These loans work by combining multiple outstanding debts into a single, more manageable loan with potentially lower interest rates. This simplifies repayment by consolidating various loan payments into one fixed monthly instalment, making it easier for borrowers to budget and stay on top of their financial commitments.

For individuals with bad credit, traditional loan options may be limited or come with stringent requirements. Unsecured Debt Consolidation Loans UK offer a more flexible alternative, as they are not secured against any assets, meaning there’s no risk of asset seizure if repayments cannot be met. This accessibility makes them an attractive solution for those looking to rehabilitate their financial standing and gain control over their debt, even with a less-than-perfect credit history.

How No Credit Check Loans Work for Debtors

No credit check loans are a popular option for individuals with a poor or non-existent credit history, offering them an opportunity to access funding for debt consolidation despite their financial challenges. These loans are designed to provide quick and easy financial support without delving into intricate credit assessments. Lenders consider various factors beyond traditional credit scores, such as income, employment status, and debt-to-income ratio, to determine eligibility. This approach ensures that people with bad credit or no credit history can still secure the necessary funds to consolidate their debts, offering them a fresh financial start.

Debt consolidation is a powerful tool for managing multiple debts, and no credit check loans make this process accessible to a broader range of individuals. By consolidating various debts into a single loan with a potentially lower interest rate, debtors can simplify repayment, reduce the overall cost of debt, and gain better control over their finances. This method allows them to focus on rebuilding their financial health without being hindered by strict credit requirements.

Top Strategies for Securing Debt Consolidation with Bad Credit

Debt consolidation is still achievable even with a bad credit history, thanks to specialised loan options available in the UK. One popular strategy involves looking for lenders who offer debt consolidation loans for bad credit. These loans are designed specifically to help individuals manage multiple debts by combining them into a single, more manageable repayment schedule.

Before applying, focus on improving your credit score by making timely payments on any existing accounts you can. This demonstrates financial responsibility to lenders. Additionally, compare various loan providers and their terms meticulously. Some lenders may offer better interest rates or flexible repayment periods, making the consolidation process more effective and less stressful.

For individuals struggling with debt and a poor credit history, unsecured debt consolidation loans UK options can provide a much-needed solution. By understanding how these loans work and employing effective strategies, debtors can take control of their finances. While traditional loan methods may be out of reach, no credit check loans offer an alternative route to consolidating debts and improving financial health. With the right approach, individuals with bad credit can access the funds needed for a fresh start.